Irs compound interest calculator

How to Use the Compound Interest Calculator. Gotrax gxl v2 speed limiter All.

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Compound Interest Calculator What is the value of compound interest.

. The IRS is required to compound interest daily effective January 1 1983 pursuant to IRC 6622a which was added to the Code by section 344a of Public Law 97-248 the Tax Equity and Fiscal. For each quarter multiply. The underpayment interest applies even if you file.

39 rows IRS Interest Formula Interest Amount Amount Owed Factor Interest Amount. Thus the interest of the second year would come out to. Use this compound interest calculator.

The interest rates we charge and pay on. Irs compound interest calculator. The calculator will use the equations.

IRC 6621 Interest is computed to the nearest full percentage point of the Federal short term rate for that calendar. Say you have an investment account that. So youd need to put 30000 into a savings account that pays a.

Irs compound interest calculator Compound Interest P 1 i n - 1 P is principal I is the interest rate n is the number of compounding periods. How We Calculate Interest Rates Interest will accrue on any unpaid tax penalties and interest until the balance is paid in full. IRS Interest Formula Interest Amount Amount Owed Factor Interest Amount Amount Owed 1 Daily Rate days - 1 Interest Amount Amount Owed 1 Daily Rate.

A P 1 rnnt. Determine the total number of delay days in payment of tax. Lets look at how we calculate the year 20 figure using our compound interest formula.

The compound interest formula solves for the future value of your investment A. The IRS charges underpayment interest when you dont pay your tax penalties additions to tax or interest by the due date. Compound Interest Formula with different periodic payments Compound interest for principal equation A P 1 rn nt Future value of a series formula - end of period A PMT pf.

Formula for compound interest A P 1rnnt Where. P the principal the amount of. Compound interest can have a dramatic effect on the growth of an investment.

An investment of 100000 at a 12. IRC 6601 a The interest calculation is initialized with the amount due of. Mortgage Loan Auto Loan.

Please pick two dates enter an amount owed to the IRS and. The provided calculations do not constitute. The compound interest formula is.

Free inflation-adjusted IRA calculator to estimate growth tax savings total return and balance at retirement of Traditional Roth IRA SIMPLE and SEP IRAs. Our calculator allows the accurate calculation of simple or compound interest accumulated over a period of time. Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations.

The compound interest of the second year is calculated based on the balance of 110 instead of the principal of 100. The new back pay interest calculator will assist agency human resources payroll and finance offices and Shared Service Centers in calculating back pay interest for Federal. A the future value of the investment or loan P.

TaxInterest is the standard that helps you calculate the correct amounts. R n AP 1nt - 1 and R r100. You will have to compute interest-based on IRS quarterly interest.

Select the currency from the drop-down list this step is optional. To calculate the monthly interest on 2000 multiply that number by the total. 110 10 1.

In the calculator above select Calculate Rate R. This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties. IRS Interest Calculator.

You Are Excited And Debt Free Now What

Paycheckcity Has A Full Array Of Free Paycheck Calculators Tax Refund Time Value Of Money Saving Goals

Compound Interest Calculator Arrest Your Debt Interest Calculator Personal Financial Planning Investing

Form 11 Mortgage Interest Deduction Understand The Background Of Form 11 Mortgage Interest D Irs Tax Forms Mortgage Interest Irs Taxes

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

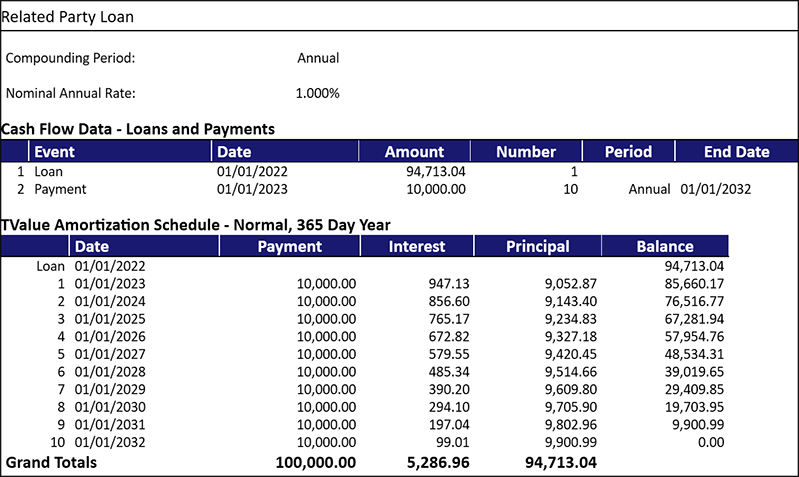

Calculating Imputed Interest For Related Party Loans Timevalue Software

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs State Interest Calculator Tax Software Information

What Is Managerial Economics Learn The Importance Of Managerial Economics And The Objecti Investment Analysis Managing Your Money Personal Financial Statement

Easiest Irs Interest Calculator With Monthly Calculation

Quick Review Of Irs Changes To Ira And 401k In 2019 Dr Breathe Easy Finance Finance 401k Personal Finance

Indices Are The Best Way To Calculate Compound Interest

This Is A Primer On The Various Stock Orders And Much More Important How To Use Them Most People Are Aware Of Market Orders How To Become Primer Awareness

Pin On Money Smart Week

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Indices Are The Best Way To Calculate Compound Interest